tax strategies for high income earners australia

How Can A High Earner Reduce Taxable Income In Australia. August 12 2014.

How To Pay Less Taxes For High Income Earners Wealth Safe

In this case they could distribute the trusts profits to trustees while remaining under the tax-free threshold thereby creating wealth by decreasing.

. So a banker doctor making 1m. With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to consider some planning strategies to lessen the impact. A range of both basic and advanced tax strategies and investment options can be explored to this end.

There are a number of ways to avoid tax in Australia. Jun 19 2019. Theres no doubt that everyone should be retirement planning.

Australia overtaxes high wage income earners relatively speaking. Given that most are employed in specialist occupations this takes greater time and a more detailed investigation to ensure that cover is appropriate for your circumstances. A discretionary trust would be used for distributing business profits investments.

Australias high-income earners can invest in family trusts. If you are a high-income earner it is sensible to implement tax minimisation strategies. Tax reduction strategies for high income earners australia Thursday March 10 2022 Edit.

Our highest marginal income tax rate kicks in at around 2x average earnings vs about 4x in most other countries and the rate of 47 is not low. There are a few tax strategies for high income earners that will help you save thousands or more on your taxes. In australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates.

However Im going to show you two ways to avoid tax without spending a cent. Most legal ways of avoiding tax involve you spending money and claiming a tax deduction for spending that money. A discretionary family trust can be beneficial for high income earners who are seeking to redistribute some of their income to family members on lower tax brackets.

Australia Current Situation In Control Strategies And Health System The Most Tax Efficient Company Structures To Reduce Tax Burdens Wealth Safe. Now we must be careful with the term avoid tax because tax. Tax advice for high income earners.

Effective tax planning with a qualified accountanttax specialist can help you to do that. The budget would also raise the. Why is this important.

Individuals with a taxable income of between 50k and 250k tax brackets gain the most from this strategy due to the super tax rate 15 versus your marginal tax rate. Some of them legal some not-so. Its important because after-tax money that grows tax deferred in a 401k is extremely beneficial.

Asset and debt structuring can be key to. The amount of offsets you get from your taxes Having a smaller capital gains tax CGT liability. One allowable tax deduction that can also be a significant long-term wealth creation strategy is maximising your voluntary superannuation contributions.

Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the Australian Tax Office ATO. Reduce the income tax paid on dividends through franking credits. Appropriate types and amounts of insurance cover.

Besides the fact you want a comfortable retirement investing in certain types of retirement accounts is one the best tax strategies for high income earners. These penalties can range from fines to imprisonment for more. You can currently claim up to 27500 as a tax.

Typically a high income earner will maximize their yearly pre-tax 401k contributions 18000 or 24000 but if after-tax contributions are allowed then up to an additional 36000 can be contributed. A family trust or a discretionary trust can be a means for them to build wealth if they apply tax-effective financial strategies. The maximum amount that can be contributed to superannuation as a concessional contribution is 25000 per financial.

If you are among them then you shall definitely need guidance and support from experienced tax accountants and CPA accountants. The taking care of your partners assets. New Tax On High-Earners And Billions For Police Housing And More.

Keep in mind that the ATO keeps a strict watch over the high-income earners and there is no way for you to escape. With the Medicare levy already legislated to increase from 15 to 2 from 1 July 2014 the rise in levies will effectively be 25 for. This rate is lower than the personal income tax rate.

This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. And when ultimately rolled. Tax deductions you may want to maximize.

1 hour agoAustralias Richest. Implementing the Tax minimization strategies is the prime lookout for every high-income earner in Hobart.

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

How To Pay Less Taxes For High Income Earners Wealth Safe

10 Easy Ways To Reduce Tax More Tips From The Etax Experts

How Do High Income Earners Reduce Tax In Australia Imagine Accounting

Advanced Tax Strategies For High Income Earners In Australia Solve Accounting

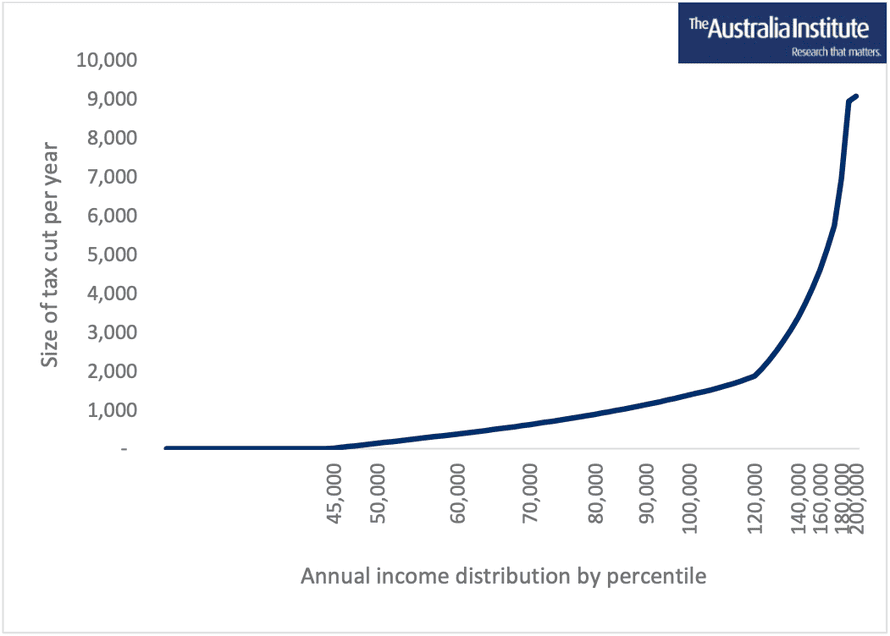

Men On High Incomes To Take Lion S Share Of Coalition S 184bn Tax Cuts Analyses Find News Magus

How To Pay Less Taxes For High Income Earners Wealth Safe

![]()

How Do High Income Earners Reduce Taxes In Australia

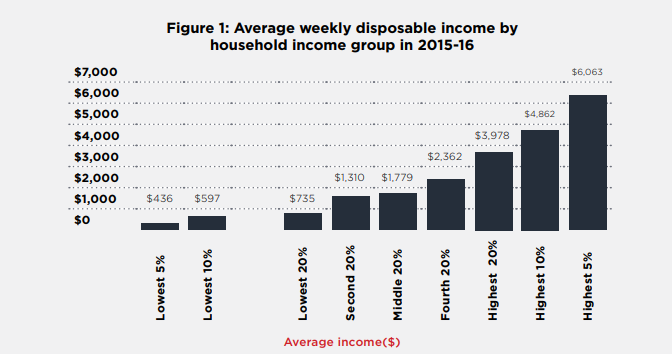

Inequality In Australia 2018 Html Acoss

How Do High Income Earners Reduce Taxes In Australia

Australian Income Tax Brackets And Rates For 2021 And 2022

What Is Considered A High Income Earner In Australia Ictsd Org

Tax Minimisation Strategies For High Income Earners

Tax Minimisation Strategies For High Income Earners

![]()

How Do High Income Earners Reduce Taxes In Australia

How Raising Tax For High Income Earners Would Reduce Inequality Improve Social Welfare In New Zealand

Tax Reform Welcome But More To Do Betashares

How To Reduce Taxes For High Income Earners Australia Ictsd Org